Over the past twelve months we’ve seen conflicting predictions regarding UK house prices. Property experts began the year on an optimistic note, but some have since revised their figures downwards. If you have just started your property search, it’s essential to know whether prices are going up or down. That’s why our estate agents in Ilford have teamed up with our estate agents in Newbury Park to bring you the latest updates.

Why have the forecasts changed?

Back in January, Rightmove confidently predicted that house prices would rise by 4 per cent this year. However, in the early spring UK Stamp Duty changes caused a spike in sales followed by a slump after the new tax levels took effect. The Stamp Duty correction, together with an increase in the number of homes available for sale, meant property values failed to rise as much as predicted. Zoopla estimates that prices across the UK have risen by 1.3 per cent this year.

What are the average property prices for East London?

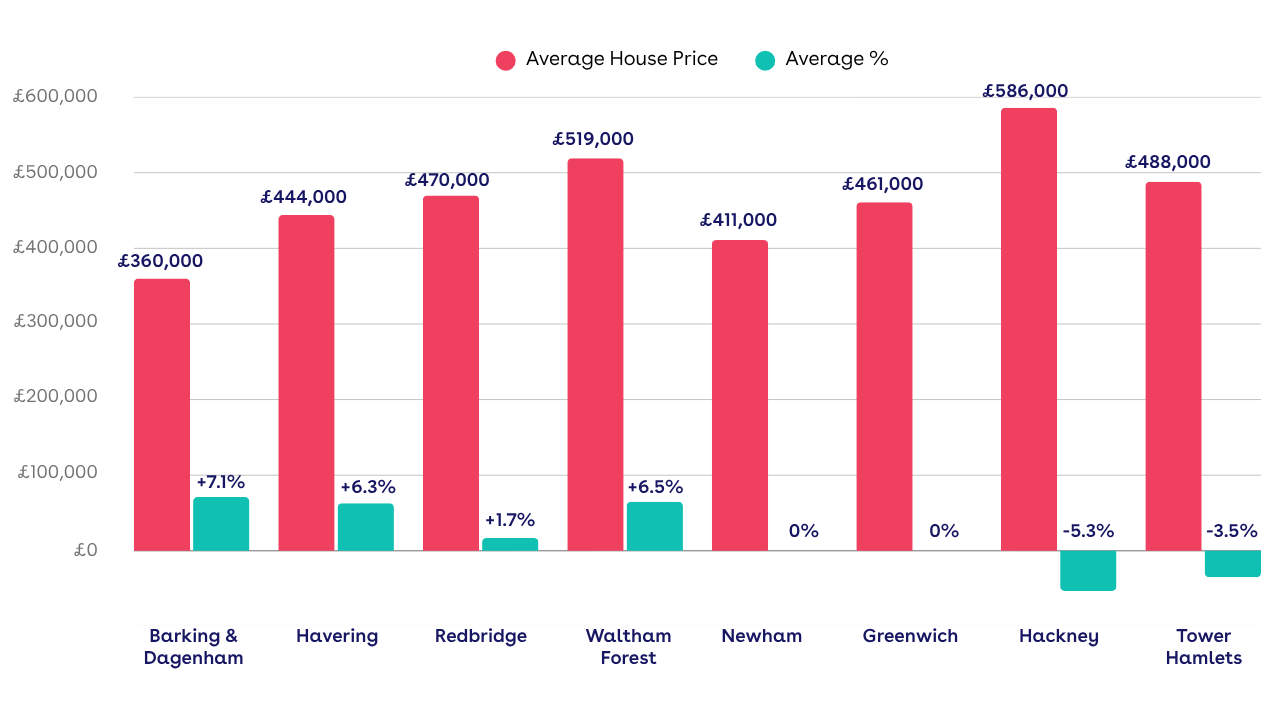

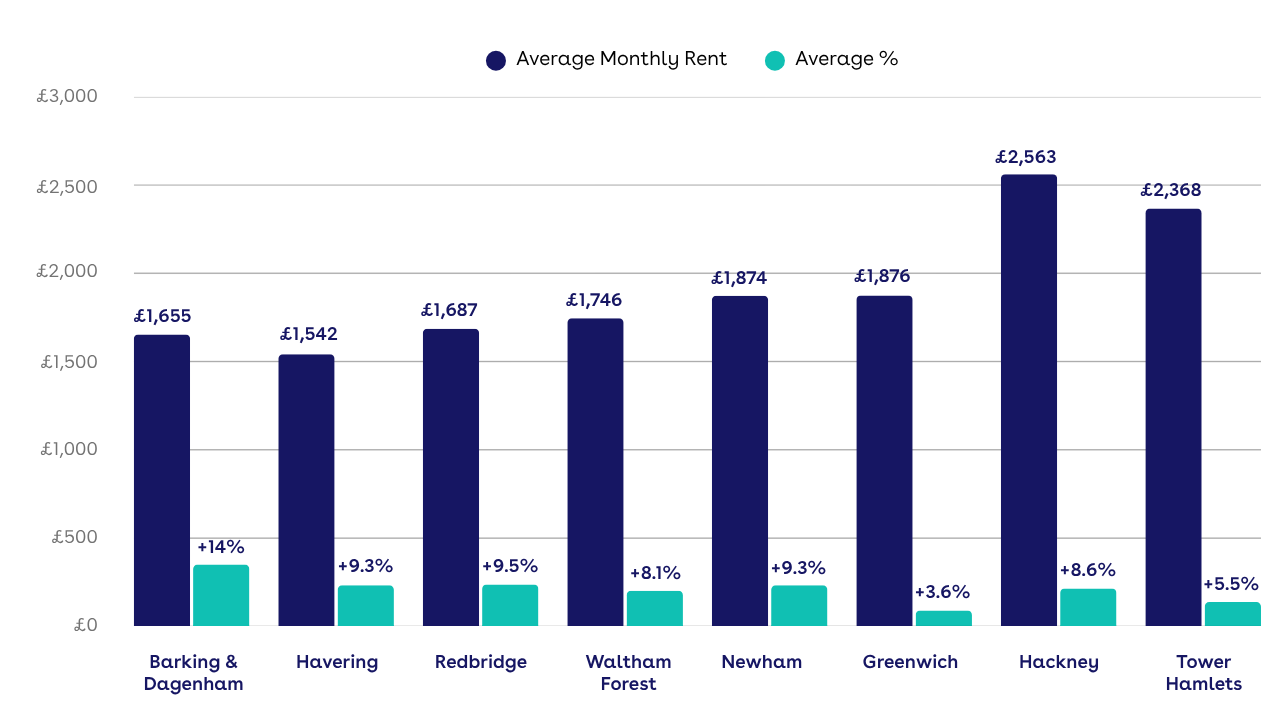

While national sold property figures may be useful to show the housing market’s general direction of travel, the situation in local areas is often quite different. In the year to June 2025, Barking and Dagenham saw house prices climb 7.1 per cent, to an average of £360,000, while rents grew by 14 per cent. Havering house prices rose by 6.3 per cent over the year, achieving an average of £444,000. Havering’s average monthly private rent rose by 9.3 per cent. This summer the average property in Redbridge cost £470,000: a 1.7 per cent rise since June 2024. Average monthly private rents rose by 9.5 per cent over a similar period, to £1,687.

Havering’s average monthly private rent rose by 9.3 per cent. This summer the average property in Redbridge cost £470,000: a 1.7 per cent rise since June 2024. Average monthly private rents rose by 9.5 per cent over a similar period, to £1,687.

In Waltham Forest prices rose by 6.5 per cent to an average of £519,000 (with rents up by 8.1 per cent to £1,746). Newham saw little change in house prices (average £411,000), but average rents rose by 9.3 per cent, to £1,874. The average house price in Greenwich (currently £461,000) remained broadly the same as the previous year, although rents rose by 3.6 per cent, to £1,876. Hackney house prices fell by 5.3 per cent, to an average of £586,000 over the year to June, while average rents rose by 8.6 per cent, to £2,563. Tower Hamlets also experienced a price drop of 3.5 per cent, recording an average of £488,000 in June. Average rents here increased by 5.5 per cent to £2,368. It should be noted that the figures quoted above are drawn from Land Registry data and may be several weeks out of date. A good local estate agent will be able to provide the most accurate information on property values in your area.

Hackney house prices fell by 5.3 per cent, to an average of £586,000 over the year to June, while average rents rose by 8.6 per cent, to £2,563. Tower Hamlets also experienced a price drop of 3.5 per cent, recording an average of £488,000 in June. Average rents here increased by 5.5 per cent to £2,368. It should be noted that the figures quoted above are drawn from Land Registry data and may be several weeks out of date. A good local estate agent will be able to provide the most accurate information on property values in your area.

What are the predictions for house prices, going forward?

Despite the Stamp Duty ‘wobble’ of early spring, the UK housing market has proved to be both stable and resilient. Over the year buyer demand has increased by 4 per cent. Available homes are still in plentiful supply. This has resulted in lower property asking prices which have boosted sales. Income growth, coupled with lower mortgages, is helping to build confidence and more buyers have been encouraged to enter the market.

Mortgage rates for first time buyers are now more affordable, with some fixed-rate mortgage deals now falling below 4 per cent. However, a further interest rate cut looks unlikely this year. Lenders have been encouraged by government to relax some of their lending eligibility tests and this has made it easier to get a mortgage.

What are the long-term prospects?

Much will depend on the health of the UK economy. It’s also possible that house prices could be affected by decisions made by the Chancellor in the Autumn Budget. There have been suggestions that Stamp Duty could be replaced by an annual property tax, swapping the burden from buyers to sellers. Capital Gains Tax (CGT) could also be extended to the profit made on selling a main home, if its value exceeds a particular threshold (for example, £1.5m).

However, neither of these ideas have been confirmed. Experts have been cautious but positive in their estimates about future price rises. Most believe that we will see price growth of around 4 per cent next year followed by rises of between 4.5 and 6 per cent each year to 2029.

Is this a good time to move?

Lower interest rates, more flexible lending rules and a wider choice of properties make this a good time to move house or invest in property. Whether you are selling to move on, investing in property or buying your first home, good local advice will help you make the right choices.

At Oakland Estates we have been active in the East London property market for 36 years. Why not contact our friendly sales team today to share your moving plans?

We’d love to help you find your perfect new home at a price that suits your budget.

Get in touch via 020 3972 7341 or email info@oaklandestates.co.uk to share your plans with us.

Meanwhile, if you’d like to find your dream home or properties to rent in Ilford, wanstead, Newbury Park, Barkingside and surrounding areas, check the links below

Properties for sale in Ilford and Barkingside

Properties to rent in Ilford and Barkingside

Don’t forget to follow our socials for the latest property market advice and listings:

https://www.facebook.com/Oakland-Estates-1426149597689066/?fref=ts